Financial Experience Maturity Model

- Mar 17, 2023

- 2 min read

Updated: May 31, 2023

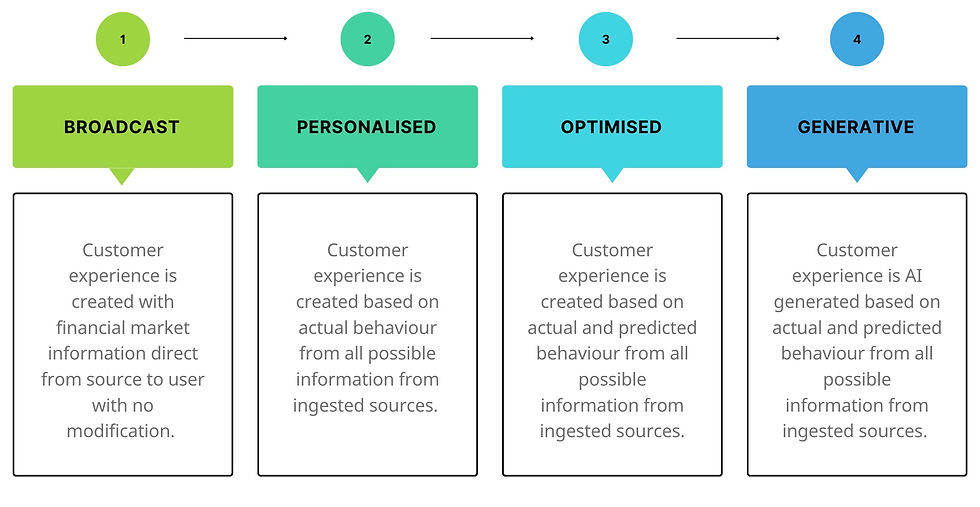

Transform your financial customer experience by understanding where you are and where you should be on the Financial Experience Maturity Model.

The financial experience maturity model is used to describe how mature or sophisticated a financial organisation is in creating a customer experience of financial markets for its customers.

I have developed the 4 phase financial experience maturity model to help brokers, banks, wealth providers, apps and fin-tech more broadly to help identify where they are and what is possible given the new technologies that are emerging. Also, importantly to understand that they are likely losing market share because they are not meeting their customers experience needs.

The four phases.

Broadcast

Personalised

Optimised

Generative

Broadcast

Broadcast is the starting point of the maturity model and is also the default of most of the financial sector in how they generate a customer experience of the financial markets. Information in the form of content and data is sent to all customers as it arrives from source. For example, news, analysis, price, charts and alerts are sent directly to the user from the source with no modification. All users receive the same user experience hence broadcast like radio and TV. The goal here is to impart market information to the user as it is created.

Personalised

The overall customer experience is created by curating the available financial information from internal and external sources for each user. Curation is based on highly dynamic personalisation models that best represent the user market preferences. Multi channel user experience is created from relevant information and all interaction are captured and mapped to instruments, topics and events in order to improve user preference model. The goal here is for an ever more relevant customer experience for everyone.

Optimised

Building on the Personalised phase, machine learning recommender models are utilised where instruments, topics and events are recommended to the user in order to grow and optimise the user market preferences. Models and user experience are variant tested in order to improve the recommender system and improve the ability of the financial experience to modify user behaviour. The goal here is to provide an ever more engaging experience where all behaviour is predictable and can be modified.

Generative

Leveraging the highly accurate user market preferences created by the personalisation and recommender machine learning models and combining them with large language model AI capabilities we move from personalised and optimised curation of existing market information to the generation of market information by summarisation and naturalisation of the markets by an LLM such as ChatGPT4. The goal here is to create a completely personalised assistant of the financial markets which creates and engages with the financial markets for each user.

Maturity Model Assessment Ebook!

I am developing a comprehensive maturity model with full capability assessment which compliments my financial experience platform components introduced in this Top 10 Components of a Financial Experience Platform so please stay tuned for that.

As always if you want to discuss anything related to financial experience innovation or real-time generative personalisation please drop me a note at adam@personalisation.ai

Thanks guys.

Cheers

Adam

Comments