Real-time personalisation delivered

Moving to real time personalisation will change every facet of your financial business because you are moving from market driven and ops driven engagement to human centric financial experience.

There are strategic verticals that should be considered and capabilities that contribute to the personalisation and financial experience maturity of your organisation. I can help you on this journey.

Services

I have worked across project, programme, product, innovation compliance, sales, marketing, data and data science workstreams. I have delivered ground breaking retail and financial customer experiences as well as operational, legal and compliance frameworks and platforms.

I would like to work with any teams who are looking to deliver new and innovative data driven AI products to market and can work within the following verticals:

01

Strategy

Real-time personalised financial customer experiences can dramatically change how your financial institution runs. I can help you develop a capability roadmap to personalisation and financial experince maturity that aligns to your transformation journey.

02

Content & Data

A real-time personalised CX is dependant on the total available content and data inventory. each CX is generated from curating information from this inventory and it is one of the richest most dynamic information ecosystems. I can help you understand it and use it efficiently.

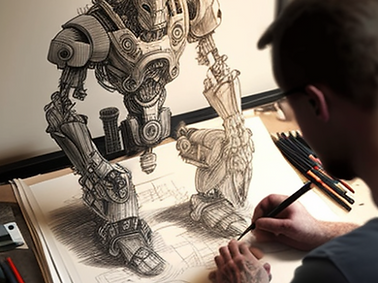

RobotProduct.png)

03

Product

Real-time generative CX need a different product management mindset. its a far more dynamic experience that relies heavily on understanding possible data source scenarios rather than designing a fixed UI/UX. I can help product teams understand the art of the possible.

04

Data & Analytics

Your move to behaviour analytics will unlock so much value in how you run your business and how you manage operations such as sales, marketing and product. I can help you move to engagement measurement based on market preferences and behaviour not click throughs.

05

Technology

The technology hurdles to delivering a real time personalised financial experience have never been smaller. From NLP/NER to a financial knowledge graph or headless architecture or design of your personalisation and ML recommender systems I can help inform your teams what components and technologies are needed.

06

Machine Learing

Developing the models for creating a personalised financial experience can be daunting. However I can work with your data science, product, compliance and desk teams to understand the options for collaborative and content filtering that will form the basis for the preference and recommender systems.

07

Compliance & Regulation

Deploying any type of AI or capturing customer behaviour data for the purposes of providing a dynamic customer experience has significant regulatory and compliance policy and reporting implications for financial institutions. I can help you understand the policy and reporting framework.

08

Sales Optimisation

Align your sales desks and marketing teams to the exact unique personalised financial CX your customers are receiving to create omni channel strategies. I can help your teams unlock micro segmentation and targeting with granular user market preferences and behaviour data.